Between April 2011 and February 2012, the SPDR Oil & Gas Exploration & Production ETF (XOP) returned 45.8%. The iShares Global Energy (IXC) returned 29.5% and the Energy Select Sector SPDR ETF (XLE) returned 31.4%. During the same period, the United States Oil (USO)—the crude oil tracking ETF—returned 40% compared to XOP’s 45%. These energy equity ETFs’ returns include dividends. During the last two crude rallies in 2006–2008 and 2009–2011, XOP outperformed USO, IXC, and XLE.

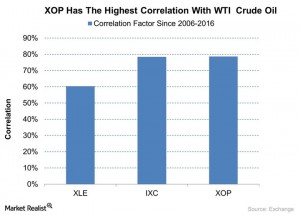

Energy ETF correlations with WTI crude oil

XOP had a correlation of 78.6% with WTI (West Texas Intermediate) crude oil from June 27, 2006, to March 9, 2016. IXC had a correlation of 78.4% with crude oil during the same period.

Article Author:

Market RealistArticle Source:

http://marketrealist.com/2016/03/key-etfs-crude-oil-rallies/0 views