“Shocking” data from Oklahoma may be moving the oil market this week as much as the shouting between Saudi Arabia and Iran, WSJ‘s Nicole Friedman reports. First, data released Thursday showed that while U.S. oil production is falling, overall output is higher than previously reported; new reporting methodology prompted the EIA to revise its production data higher for …

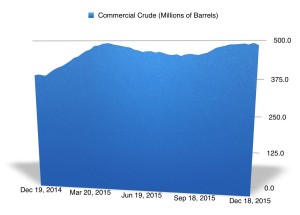

Summary Oil prices soared this past week, driven largely by great news coming from the EIA. Although not every indicator (think production) was bullish, the drop in inventories was impressive and shows signs of potential capitulation. Add to this the drop in the Baker Hughes rig count and investors should remain more bullish than bearish …

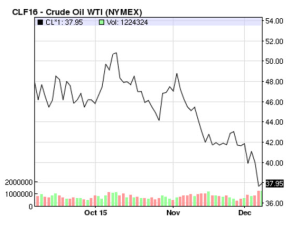

Summary WTI crude oil prices peaked at $105 per barrel in June 2014 and fell to a low of $37.65 on Dec. 7, 2015 (down more than 64% of its price). Overproduction, high inventories, Saudi Arabia’s battle with U.S, shale oil producers and with Iran, and OPEC’s failure as an institution are the main causes. …

With the rise of Islamic extremism in the Middle East and Daesh (or ISIS, ISIL, IS, or whatever you want to call it) in control of oil fields in Iraq, one of the biggest surprises this year has been the plunge in oil prices. Although the decline actually began during the second half of last …

Summary Why OPEC’s current position in the oil industry is misunderstood. The time factor and how it relates to Saudi Arabia and its budget. U.S. shale and companies exposed to it have changed the oil industry forever. It continues to boggle my mind when reading or listening to much of the analysis surrounding the oil …

Summary Oil traders are panicking. Take advantage. 3 billion barrels in storage seems like a lot. It is not. Demand is increasing supply is not. Geopolitical risks are totally priced out of the market. I expect a 50% rise in oil prices in 2016. Oil is mispriced under $40, especially for 2016 The price for …

In a report shared with investors on Monday, 7 December, Eland Oil Gas PLC (LON:ELA) stock had its Buy Rating kept by equity analysts at Panmure Gordon. Panmure Gordon now has a GBX 130.00 TP on the 52.84M GBP market cap company or 257.34% upside potential. Nostrum Oil & Gas PLC (LON:NOG) traded up 0.8788% …

New York, New York – December 7, 2015. Micro Cap Company Petro River Oil Corp. (ticker: PTRC) (“Petro River” or the “Company”) is pleased to announce that it has entered into a purchase agreement to acquire Horizon I Investments, LLC (“Horizon Investments”) in an all stock deal.

Oil field services companies slogging through the worst downturn in decades can no longer rely on their traditional oil bust playbook of cutting costs, laying off people and offering deep discounts. Instead, the industry will have to reshape the way it does business to meet the evolving needs of oil companies clamoring for cheaper and …